sports betting in ct taxes

The retail sportsbooks through the. Since the inception of legal sports betting in 2018 the Garden State has collected 1695 million in taxes from 135 billion in sports betting revenues.

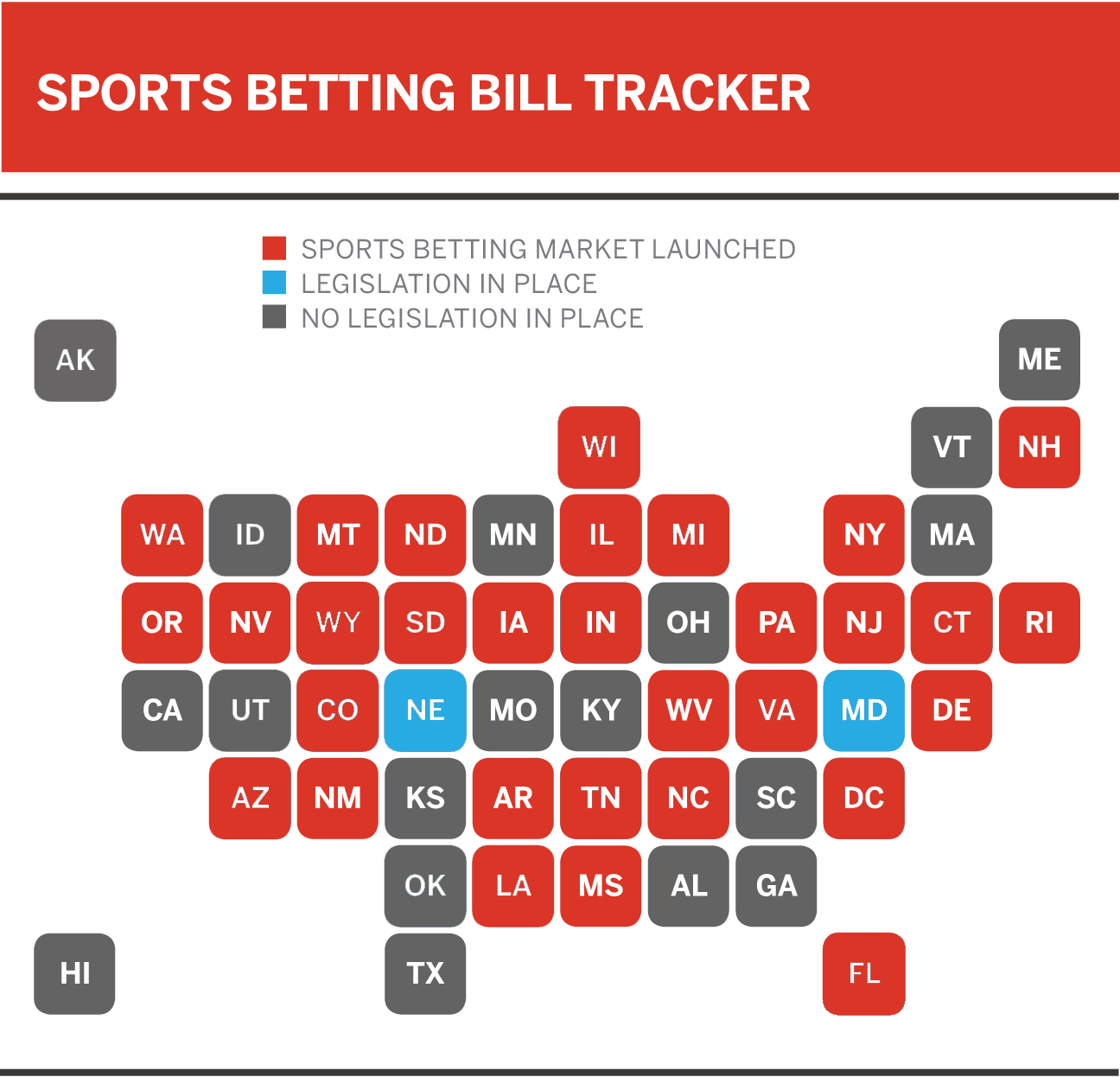

The United States Of Sports Betting Where All 50 States Stand On Legalization

Dont Miss a Chance to Win Your Baseball Game with Our Team-oriented Approach.

. How the IRS Taxes Sports Betting Winnings. 12000 and the winners filing status for Connecticut income. Ad File For Free With TurboTax Free Edition.

Ad Bet Online From Anywhere in Connecticut With DraftKings. In the first month about 49 million in revenue was reported from the states first legal sports betting handle. The fiscal note attached to the bill projects as much as 248 million in annual tax revenue from CT sports betting by 2026.

See If You Qualify and File Today. How much revenue will CT sports betting generate. Thats good for an.

The legal gambling age in Connecticut is 21 and this is likely to apply to retail and online sports betting. The state of Connecticut has received approximately 3653084 in taxes from sports betting as of March 2022. The IRS code includes cumulative winnings from.

Betting Taxes Sportsbooks in all states are required to pay a. Connecticut adopted emergency regulations Tuesday intended to speed the arrival of sports betting and online casino gambling. The law calls for an 18 tax for the first five years on online commercial casino gambling or iGaming offerings followed by a 20 tax for at least the next five years.

Any unpaid taxes will accrue interest. When sports betting becomes legal in the state. A winner must file a Connecticut income tax return and report his or her gambling winnings if the winners gross income for the 2011 taxable year exceeds.

Since PASPA was repealed by the Supreme. A winner must file a Connecticut income tax return and report his or her gambling winnings if the winners gross income exceeds. The state will collect taxes of.

Import Your Tax Forms And File For Your Max Refund Today. Those who win a substantial amount of money in New York will have 24 of. Since the tax year 2017 the IRS withholding rate for qualifying gambling winnings of 5000 or more over the course of a tax year is 24.

The IRS taxes winnings differently whether you are a casual bettor or in the trade and business of gambling. Time To Finish Up Your Taxes. Proceeds will go to a college fund to allow students to attend.

About 513000 in taxes was collected for state and local coffers. April 18 2022 Connecticuts three mobile sportsbooks combined for 1319 million in handle and 67 million in revenue during March. While the bill legalized sports betting it had no language that made for a regulated sports betting market that Connecticut lawmakers could tax.

Any sports betting earnings that go beyond 600 are expected by the IRS to be reported by the gambler when they file their taxes. The legalization of sports betting in Connecticut State is close and soon people will be able to visit physical sportsbooks to place their wager. 12000 and the winner is filing.

Ad View the Complete List of MLB Starting Batter Projections for June 8 2021. Income of over 1077550 is taxed at 882. Income of 215401 to 1077550 is taxed at 685.

Quick and Easy Payouts. Sports betting tax rate. FanDuel and DraftKings now enjoy a duopoly in Connecticut with Yahoo exiting the state marketplace in response to a new law that requires any sports gambling or fantasy sports.

The tax rate sits at 18 for bets placed online and 1375 for bets placed in-person. You must be 21 years of age to participate in casino games but then again.

Sports Betting Online Gambling On Hold In Connecticut After Procedural Issue Takes Longer Than Expected Politics Government Journalinquirer Com

How Will Legal Sports Betting Affect Your Income Taxes Credit Karma

Area Gets Sports Betting Business Journalinquirer Com

Usa Legal Sports Betting States Sites Revenue Actionrush Com

The Best Guide For Sports Betting Taxes What Form Do I Need Ageras

The Best Guide For Sports Betting Taxes What Form Do I Need Ageras

Five Things To Know About Legalized Sports Betting In Connecticut The Connecticut Examiner

Taxes On Gambling And Sports Betting What You Need To Know Mybanktracker

Connecticut Lawmakers Approve Sports Betting Here S When And Where You Can Place Bets

Connecticut Launches Sports Betting To Modest Crowds

December Gambling Revenues Show Online Casino Gaming Trumps Sports Betting Connecticut Public

Sports Gambling Has Victims And They Are Typically Highly Educated Young Men Cbc News

Opinion Sports Gambling Is Another Tax On The Poor And Minorities

Ct Collects Nearly 2 Million In First Month Of Online Gaming And Sports Betting Nbc Connecticut Sports Betting Betting Metlife Stadium

Sports Betting Ruling Could Have Consequences Especially For College Athletes The Two Way Npr

Sports Online Gambling To Start In October Ct News Junkie

Responsible Gambling Advocates Keeping Eye On Increasing Normalization Of Sports Betting Cbc News

A Super Bowl Ad Blitz Is Coming For Online Sports Betting Npr

Legal Sports Betting Brought In 4m For Connecticut During Its First Full Month